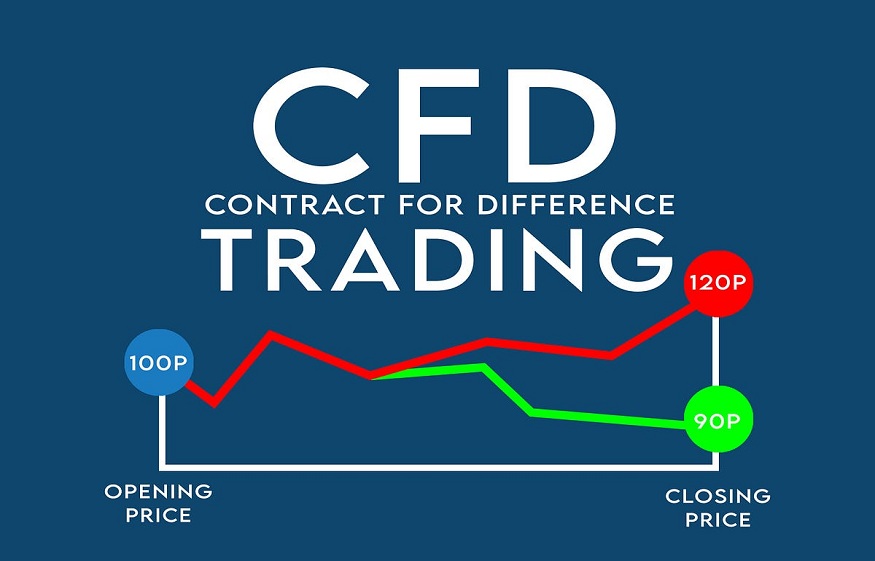

The world of CFD trading has been gaining prominence in recent years, with a growing number of people relying on this sophisticated trading tool to make profitable investments. With its flexible and convenient nature, it’s no surprise that CFDs have become attractive for those looking to benefit from the stock market without investing large amounts of capital upfront. In this comprehensive guide, we’ll explore what exactly CFD trading in the UK is, how it works and the different strategies available when trading using this method.

What are Contracts for Difference?

Contracts for Difference (CFDs) are derivative products that allow you to trade financial instruments like stocks, indices, commodities and currencies without owning the underlying asset. Instead of buying the asset outright, CFD traders enter into a contract with their broker stipulating how much to pay for each unit of the underlying asset. The value of the contract is calculated using market fluctuations in supply and demand as well as other factors such as interest rates.

Buying and selling CFDs

When buying or selling CFDs, you don’t own the underlying asset; instead, you only predict whether its price will increase within a given time frame. If your prediction regarding the price is correct, you will earn money based on your initial investment and the change in the asset price. On the other hand, if your prediction turns out wrong, you may lose some or all of your investment.

Strategies for CFD trading

When trading CFDs, several strategies can be used, and choosing the one that fits your style and financial goals is essential. One popular strategy is scalping, which involves taking small trades at frequent intervals to quickly capture small profits. Another strategy is hedging, which entails taking a position opposite to the one you already have to reduce risk.

Another prevalent strategy is trend following, which involves identifying long-term market trends and using them to make profitable investments. It should be noted that each strategy comes with its own set of risks and rewards, and you should weigh them carefully before making a decision.

What are the risks, and how do UK traders mitigate them?

CFD trading risks are considerable, and UK traders should consider them carefully before entering these contracts. Firstly, there is a high risk of financial loss due to the leverage involved in CFD trading. Leverage is when you deposit a small amount of money to gain access to a much larger market position, which can lead to significant losses if the market moves against you.

There are also liquidity risks associated with CFD trading in the UK; closing positions or getting out of trades may be challenging due to a lack of buyers or sellers in the market. Additionally, CFDs are traded on margin, so if your account balance drops too low, you will face margin calls from your broker requiring additional deposits, which can significantly eat into any profits made.

Certain events, such as political unrest or natural disasters, can lead to rapid market fluctuations and cause losses for traders who are unprepared for such changes. To mitigate these risks, UK traders must do their research and ensure they understand all aspects of CFD trading before committing any capital. They must also remain vigilant by keeping up to date with news related to their assets and monitoring their trades regularly.

UK traders should utilise tools such as stop loss orders and take profit orders to manage their risk more effectively. Stop loss orders allow traders to automatically close positions if they reach a certain level below the purchase price. At the same time, taking profit orders allows them to exit at predetermined gains without being monitored constantly. An adequate risk management plan is essential for mitigating the risks associated with CFD trading, which includes understanding how much money you’re willing to lose on each trade and setting realistic goals you can achieve over time.

Many UK traders use a regulated broker as this provides additional protection and peace of mind. A regulated broker has been authorised by the Financial Conduct Authority (FCA) to offer CFD trading services in the UK, and they must adhere to strict regulations regarding client funds.

The bottom line

CFD trading can be a lucrative investment opportunity for those looking for flexible and convenient ways to take advantage of financial markets. However, due to its complexity and the associated risks, traders must understand how CFDs work and have an adequate risk management plan before trading. By researching the different strategies available, utilising tools such as stop loss orders and taking profit orders, and using a regulated broker, traders can significantly reduce their risk while maximising their profits.

As with any investment, you must do your due diligence and be fully informed before taking any CFD trades. However, with the proper knowledge and strategies, CFD trading can effectively generate profits from the stock market. By following this comprehensive guide, traders should better understand CFDs and how they work, allowing them to take their investing to a new level.

The Role of Fluoroscopy and Neuronavigation in MISS

The Role of Fluoroscopy and Neuronavigation in MISS  Ayurvedic Hair Oil: Nourish and Restore Your Hair’s Naturally

Ayurvedic Hair Oil: Nourish and Restore Your Hair’s Naturally  Is Hiring a Padel Court Maintenance Service Really Worth It?

Is Hiring a Padel Court Maintenance Service Really Worth It?  Your Guide to Managed IT Solutions in San Marcos: Keeping Your Business Running Smoothly

Your Guide to Managed IT Solutions in San Marcos: Keeping Your Business Running Smoothly  What Benefits Come with Selecting Short-Term Apartment Rentals for Vacations?

What Benefits Come with Selecting Short-Term Apartment Rentals for Vacations?  EBC Trek for Beginners: Sherpa Guidance Made it Easy

EBC Trek for Beginners: Sherpa Guidance Made it Easy  What is the best hospital for normal deliveries in Hyderabad?

What is the best hospital for normal deliveries in Hyderabad?  Is Agentic AI the New Frontier of Generative AI?

Is Agentic AI the New Frontier of Generative AI?  7 Artforms Indigenous To India

7 Artforms Indigenous To India